The USDA has officially released the new Cost of Living Adjustment (COLA) for the Supplemental Nutrition Assistance Program (SNAP), and most low income households across the U.S. will see changes starting October 1, 2025. These updates affect how much food assistance you can receive, how much you can earn and still qualify, and how certain deductions are applied.

Here’s what you need to know about the updated benefit levels, income limits, and other important policy changes taking effect for the 2026 fiscal year.

SNAP Benefit Amounts Are Changing

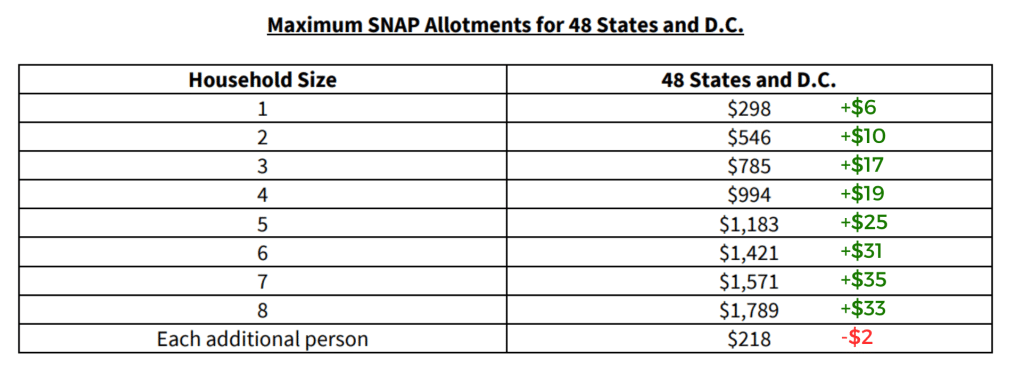

Households in the 48 contiguous states and Washington DC will see a modest increase in the maximum SNAP benefit amount. For example, a family of four can now receive up to $994 per month, which is slightly higher than last year.

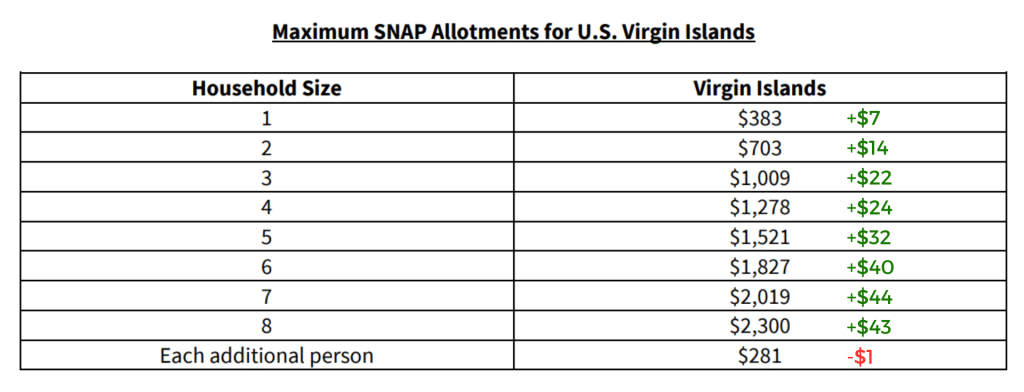

Alaska, Guam, and the U.S. Virgin Islands are also receiving increases, although the exact benefit levels vary based on specific regional cost tables.

Hawaii Will See a Reduction

Unfortunately, Hawaii is the only state where benefits are decreasing. The new maximum for a four-person household in Hawaii will drop to $1,689 per month, a reduction of up to $62 depending on household size. The per-person increase for larger households is also lower than it was last year, which could hit bigger families especially hard.

For those receiving the lowest possible SNAP allotment, there’s a small boost this year. The minimum monthly benefit is increasing from $23 to $24 in most states. While it’s not a major change, it’s still an improvement for households at the bottom tier of eligibility.

SNAP Deductions Are Being Updated

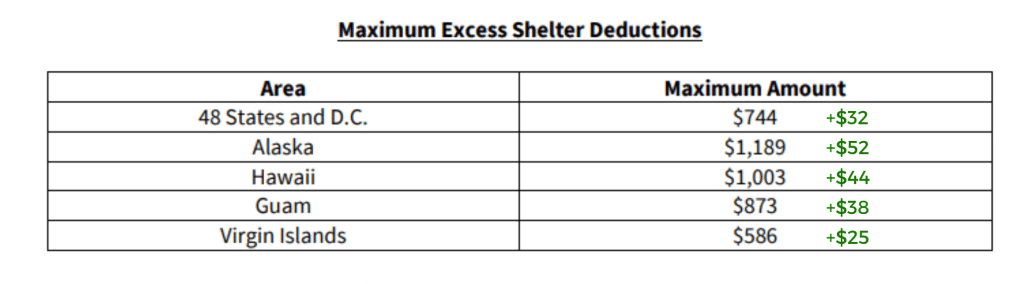

Several key deductions that reduce your countable income are being adjusted upward. The standard deduction, which is automatically applied based on household size, will rise slightly in most areas.

The excess shelter deduction, which helps account for high housing costs, is also increasing.

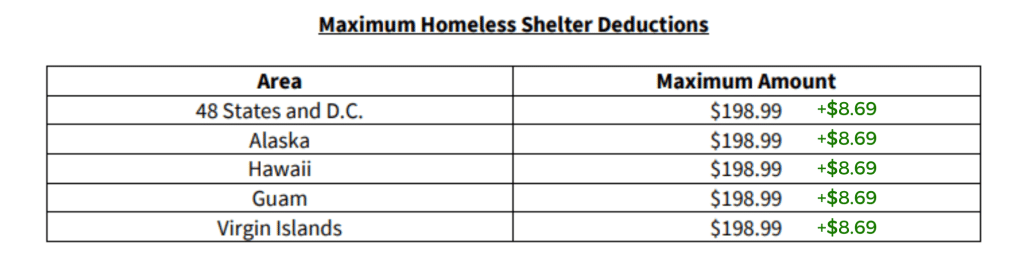

The homeless shelter deduction is also going up. This deduction is available to individuals without stable housing and can provide much-needed relief for those in transitional living situations.

Income Limits Are Increasing Nationwide

Gross and net income limits are going up across the board, which means more families may now qualify for SNAP even if they were previously just over the limit. This change applies to every state and U.S. territory, including Hawaii.

If your household includes someone who is 60 or older or has a disability, you may qualify under higher income thresholds. These expanded limits help protect vulnerable households from losing access to critical food assistance.

What’s Not Changing in 2026

Asset Limits Remain the Same

While benefit amounts and income limits are changing, asset limits will stay the same. Most households must remain under $3,000 in countable resources, or $4,500 if someone in the household is elderly or disabled.

Income Reporting Thresholds Stay Flat

The rule requiring certain households to report income changes over $125 is not changing. Whether this applies to you depends on your specific reporting requirements, so it’s a good idea to check with your local SNAP office if you’re unsure.

Other Policy Changes You Should Know

Internet Expenses Are No Longer Deductible

Under new USDA guidance, internet bills can no longer be counted as part of your utility deduction. While other utility costs are still factored in—with a modest 2.7% increase—removing internet expenses may lower utility deductions for some households.

Stricter Rules for Heating and Cooling Deductions

Households without a senior or disabled member will now need to prove they pay for their own heating and cooling in order to qualify for the full standard utility deduction. If your household includes someone who is elderly or disabled, you can still receive this deduction even if you’re getting help from LIHEAP or a similar energy assistance program.

SNAP-Ed Program Has Ended

The SNAP-Ed program, which funded nutrition education and services like produce prescription programs, has been discontinued. Some states may continue these efforts temporarily with approved extensions, but most will be required to end their programs and return any unused funds.

A Smart Way to Protect Your Benefits

If someone in your household has a disability, consider opening an ABLE account. These savings accounts allow individuals with disabilities to save money without affecting eligibility for SNAP, Medicaid, or SSI. And starting January 1, 2026, more people will be eligible to open ABLE accounts due to updated age rules.

Relief Recap

SNAP benefits are getting a small but important boost in most areas starting this October, with higher maximums, expanded income limits, and more generous deductions making it easier to qualify. However, Hawaii will see a reduction in benefit levels, making it critical for residents there to recheck their eligibility and benefit amount.

If your circumstances have changed—or even if they haven’t—it’s worth revisiting your eligibility this fall. These updated rules may mean more support is available to your household than ever before.

Do you have any information on benefits in Puerto Rico?

Thanks

Thanks for asking! We haven’t covered much in Puerto Rico yet, but we’re working on it. Here’s what we have so far: https://lowincomerelief.com/financial-assistance-in-puerto-rico/ —and we’ll keep adding more as we find it.

I live in colonies NY. I need car repair help, soon. Any suggestions?

Thanks for reaching out—car repairs can be such a huge challenge when money is tight. While we don’t have a program list specific to Colonie, NY, you might start with this resource: https://lowincomerelief.com/free-cars/. It includes info on car repair help, donated vehicles, and programs that may offer emergency assistance. Also, try calling 211 to ask about local organizations in your area that might help with car repairs. Wishing you the best in getting back on the road soon.

I called 211 but they could not help. Please I am feeling desperate how do I find someone to help??