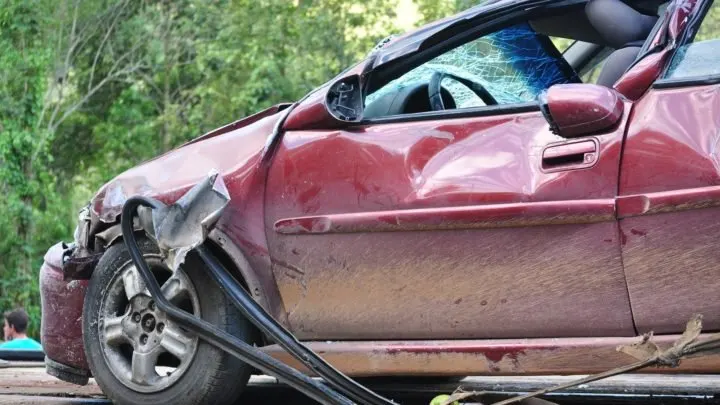

So you were in a car accident that wasn’t your fault, but the responsible party’s insurance won’t pay… Now what?

Car accidents are stressful, and they’re even more stressful when negotiations with the insurance company don’t go smoothly. Typically, the responsible party’s insurance covers the damages from the wreck. But what should you do when they refuse? Read these tips below to find out!

Why would they refuse to pay?

When the police name the other person as the one responsible for the crash, you would assume that getting the compensation you deserve for the damages would be an easy, smooth-sailing process. Unfortunately this is not always the case. There is a wide variety of reasons why the responsible party’s insurance company may refuse to pay for the damages, but here are the two most popular:

Fault Disputes

Insurance companies conduct their own investigation into the accident once they collect all the details. After doing so, they may find that the police incorrectly placed blame on the other person involved in the accident. In many cases, they’ll decide that it was neither party’s fault, and it was quite simply “just an accident.” In other cases, they’ll try to shift the blame on to you. Either way, they will refuse to issue you any payment for the damages.

Compensation Disputes

If the responsible party’s insurance company thinks you’re seeking more money for the damages than you deserve, they may refuse to give you the entire amount. In this case, they may release some of the funds and withhold the rest. This happens often in cases that involve medical treatment, as the insurance company may feel that you are seeking medical treatment that isn’t necessary. It can also occur if they feel that the mechanic over-charged you to fix your vehicle.

Regardless of the reason, what do you do?

Regardless of the reason that the insurance won’t pay, there are some things you can do to fix it.

Call your insurance company.

Let them know about what occurred, and ask them what to do. They will likely tell you to file a complaint with the other insurer while they fight for reimbursement, or they’ll advise you to file a claim with them to cover the damages. Either way, calling your own insurance company is an A+ place to start.

Ask for a reason.

Approximately 60% of all insurance claims are unjustly denied, but less than 1% of people question why the claim was denied. Ask the responsible party’s insurance company for a written explanation as to why they’re refusing to pay. Most states require that insurers provide written explanations of their decisions upon request, so if the company refuses, they may be breaking the law.

Contest the decision yourself.

Write a letter to the responsible party’s insurance company addressed to the person who denied the claim. Send a copy to their supervisor as well. Include the claim number, copies of all relevant forms, bills, and documents, and include description of the problem. In a short, concise manner, describe the accident, as well as the circumstances surrounding the insurance company’s denial of your claim. In your letter, give them an explicit deadline. Request that they respond within a certain time frame (30 days, for example), and state that you will be seeking legal counsel to handle this issue if they do not respond within that deadline.

Follow up.

If you receive no response, send follow-up letters to the insurance company’s consumer complaints department or customer service department, as well as to a higher-up like their CEO or president. Include the date of the incident and your claim number, and briefly explain that you’re following up on your original letter (which you got no response to) seeking to receive compensation for the damages caused by the responsible party. Don’t forget to attach your original letter to the follow-up.

Get outside help.

If necessary, add pressure. Enlist help from your state’s Department of Insurance or Department of Financial Services, a professional arbitrator, or an attorney.

Reaching out to your state’s Department of Insurance or Department of Financial services is free. The amount they can help with this issue varies from state to state, but states with strong departments (New York, California, Illinois) can help mediate your dispute.

Professional arbitrators help people settle disputes outside of court. They hold private, confidential hearings, which are less formal than a court trial, and are usually attorneys, business professionals, or retired judges with expertise in a particular field. Resolving a case through arbitration is typically less costly than taking formal legal action in court because the process is usually quicker and less complicated.

Hire an attorney.

If none of the above works, the next step is to begin the search for a legal aid or attorney. You can start by checking out our Legal Aid list, organized by state. Ideally, you’ll find one who is experienced in car accidents and insurance claims, but regardless, you’ll need an attorney’s help. We know attorneys can be pricey; however, some work on car insurance claims for a percentage of the settlement rather than seeking money upfront. This avoids the issue of having to produce a large sum of money upfront, because they will only take money once you’ve won the settlement.

Once you’ve found an attorney, have them write to the responsible party’s insurance company. In the letter, your attorney should include why the insurance company’s refusal to cover the damages to your vehicle is unacceptable, and indicate that you will be disputing this claim until the compensation is released to you. Typically, this will be enough to convince the insurance company to release the funds to you, but if it’s not…

Your case might be going to court.

If your attorney contacted the insurance company regarding their refusal to pay for your damages and they still won’t budge, a lawsuit may be in order. In general, most cases don’t go all the way to a formal trial. Rather, they are settled in pre-trial proceedings when all the necessary information is collected and exchanged between attorneys.

However, if your case does end up going to trial, don’t worry – that’s what your attorney is here for. They’ll walk you through exactly what you’ll need to prepare for the trial – any pictures from the accident, accident-related bills and invoices, and a copy of the accident report from the police – and after the trial, the judge will determine if you are owed compensation, and how much you should receive.

If you’re in a car accident and the responsible party’s insurance won’t pay, don’t panic. Follow the steps listed in this article – call your insurance company, write letters, and enlist outside help if necessary – to help receive the compensation you deserve.

Save Money & Get Free Stuff!

Disclaimer: This article is for informational purposes only and does not constitute specific legal advice. Please see our Legal Aid list (where you can view a list of legal aids by state) and check out JustAnswer (where you can talk to certified experts) for specific legal advice.