Approximately 1 in 10 Americans have medical debt of at least $250, according to a recent study by the Kaiser Family Foundation. Overall, this totals to hundreds of billions of dollars, with at least 3 million people each owing $10,000 or more.

Medical debt is a big deal, especially for low income Americans, who are disproportionately impacted by high medical bills. Luckily, there are some existing policies to help people struggling with medical debt.

Will medical debt impact my credit score?

While large medical bills may heavily impact your finances, there may be good news. Recently, three of the country’s largest credit bureaus, TransUnion, Equifax and Experian, have agreed to remove paid medical debts from credit reports. Starting in July 2022, Americans who have successfully paid off their medical bills will no longer have negatively impacted credit scores.

In addition to this, the three companies will also remove the following from credit score reports:

- Unpaid medical debts sent to collections less than a year ago. Prior to this change, Americans had only six months to pay bills sent to collections before they appeared on credit reports.

- Medical debt totaling to under $500.

If your medical debt does not fall into one of these categories, it is important that you settle it as soon as possible. According to debt.org, medical debt is the number one cause of bankruptcy in the United States. A low credit score can impact your ability to get a credit card, mortgage on a house, or other type of loan. Fortunately, Low Income Relief already has guidance on how a low income family can purchase a home, even with a low credit score.

Are there any laws to help protect me from collection agencies?

Many Americans have fallen into medical debt after receiving a “surprise medical bill,” which is an unexpected bill from an out of network facility. Often, patients are not aware that a provider or facility is out of network, due to a sudden illness or accident which requires them to receive prompt treatment.

Luckily, the No Surprises Act (NSA), effective as of January 1, 2022, will protect Americans from this type of surprise bill. This federal policy bans the following types of bills:

- Out of network cost-sharing, such as out of network coinsurance or copayments. This is for all emergency services, as well as some non-emergency services.

- Surprise bills for all emergency services from an out of network provider and or facility.

- Out of network charges for services considered supplemental care. For example, this includes anesthesiology or radiology, for out of network providers which work at an in network facility.

In addition to these protections, Americans without health insurance are guaranteed a “good faith” estimate. This is an estimated required by law, which must be provided to the patient before they receive any medical care. If a patient is billed more than $400 above the “good faith” estimate, they may be able to dispute these charges, due to the No Surprises Act.

Are there any medical debt forgiveness programs?

In April 2022, the Biden Administration announced several new plans to lessen the burden of medical debt on Americans. While these plans are not yet set in stone, Biden and Harris said they will focus on the following areas:

- Assisting more than half a million of low-income American veterans in getting their debt related to medical bills forgiven;

- Holding medical providers, as well as debt collectors, more accountable for their harmful practices;

- Better informing American patients of their rights concerning medical care and the associated debt;

- Reducing the impact of medical debt on credit reports, so that Americans with medical debt can still get a loan for a home, small business, or related area.

In February 2021, Senator Jeff Merkley of Oregon introduced the Medical Debt Relief Act of 2021, to establish a 1-year waiting period before medical debt appears on a person’s credit report. In addition, the law would also remove all medical settled debts from credit reports, as the three credit bureaus have already committed to do. However, this law would require all credit bureaus to follow suit. The law would amend the Fair Credit Reporting Act and work to better protect Americans.

Who is most impacted by medical debt?

Medical debt differs by generation, racial identity, and various other demographics.

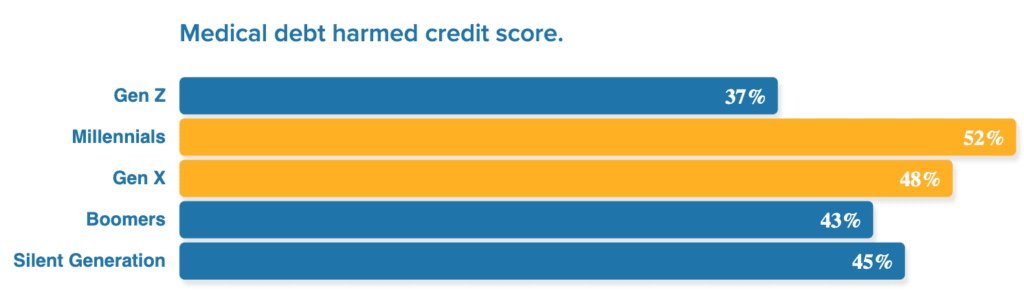

According to a 2021 survey by healthcare.com, millennials and Gen Z individuals are most impacted by medical debt. More specifically, 52% of American millennials had debt from medical bills that negatively impacted their credit scores.

68% of Gen Z had a health insurance plan that didn’t cover the health care service they received. Even more shockingly, one in four Gen Z and millennials decided to skip rent or mortgage payments, to instead repay medical debt.

Among racial groups, Black Americans (16%) were more likely to report medical debt than other races. Only 9% of White people, 9% of Hispanic people, and 4% of Asian Americans reported this kind of debt.

There are also other factors which increase a person’s likelihood of having medical debt. 21% of people in poor health and 15% of people with a disability have debt due to medical bills, since they are more likely to require and need expensive medical care.

In Conclusion

If you have medical debt, it is important not to panic, and to develop a plan. Often, hospitals and medical providers are willing to work with you, and create a payment plan or negotiate prices. In fact, according to law, nonprofit hospitals are required to offer financial assistance programs. If you’re out of options, make sure you contact your local and state service to find out if there are additional resources available to you.