Rent to Own scams are getting a lot of attention on social media, where the dream of affordable homeownership seems just a click away. It’s easy to get caught up in the excitement when you see a post about a cute home available at an unbelievably low price.

These posts often get shared around because, let’s face it, who wouldn’t want to snag a great deal on a house? The problem is, these too-good-to-be-true offers are often exactly that: not true.

In this article, we’re going to explain how you can spot a rent to own scam so that you can keep yourself safe!

What is a Rent to Own Scam?

In the quest for homeownership, rent to own agreements offer an appealing bridge for many aspiring homeowners, especially those who may not currently qualify for traditional financing.

These deals promise the dream of owning a home by starting as a tenant, with the option to buy the home at a later date, often with a portion of the rent going towards the purchase price. However, where there’s opportunity, there’s also risk—particularly from rent to own scams that prey on the hopes and vulnerabilities of individuals looking for a place to call their own.

Rent to own scams have proliferated in the housing market, cunningly designed to exploit those eager for affordable homeownership. These scams can range from non-existent property listings to misleading contracts that never actually lead to home ownership. Such schemes not only dash the dreams of prospective buyers but can also result in significant financial loss and personal information theft.

How Rent to Own Scams Work

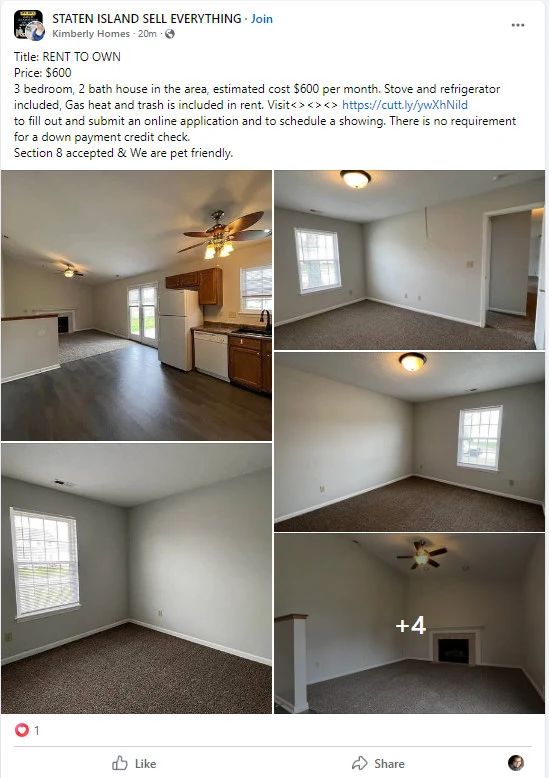

Rent to own scams often entice potential victims with attractive listings that promise a great home for a very low price, as seen in the example image below.

These scams work because they’re built on hope. The posts or ads usually come with compelling stories—maybe the owner needs to move quickly for a job or there’s a unique situation that’s led to this incredible deal. It sounds just plausible enough to make you think you’ve stumbled upon the deal of a lifetime. But when you follow the links provided to learn more or secure the deal, you’re led down a path that can result in financial loss or, at best, wasted time.

Often, the scammy links might take you to a website asking for personal information or a deposit to “hold” the property. Sometimes, they’ll ask for an upfront fee to access more information about the property or to start the rent to own process. Unfortunately, once the rent to own scam is complete and the scammers have what they want—your money or your data—they disappear, and so does the dream of that affordable home.

Here’s how the scam typically unfolds using this scenario:

- Attractive Listing: The post advertises a 3-bedroom, 2-bath house for an estimated cost of $600 per month. This rate is unusually low, which is the first red flag, as it is likely below the market rate for such properties.

- Easy Terms: The listing states there’s no requirement for a down payment or credit check. This is unusual for rent to own agreements, which typically involve some form of financial vetting. The claim that Section 8 is accepted and the property is pet-friendly is designed to appeal to a wider range of people and may not be true.

- Urgency and Accessibility: By stating that all you need to do is fill out an online application and schedule a showing, the scammer is making the process seem urgent and easy. This can pressure potential victims into acting quickly without doing proper due diligence.

- Suspicious Link: The provided link is likely a shortened URL, which is a common tactic used by scammers to disguise the destination URL and lead you to a phishing site or a form designed to harvest personal information or financial details.

- Request for Money or Information: Once you click the link, you might be prompted to enter personal information or pay an application fee to proceed. This could lead to identity theft or loss of money.

- No Actual Property: In many cases, the property may not exist, may not be for rent, or the person advertising it may not be authorized to rent it out. If a victim pays any money, they’re likely never to see it again.

In the example provided, a scammer may have taken real photos from another listing or property to make the scam seem legitimate. The price and lack of traditional rental or purchase requirements are significant red flags. Always verify property details independently, and be wary of any process that doesn’t follow the standard practices for renting or buying a home.

Signs of a Rent to Own Scam

Beware of the red flags that signal a rent to own offer might be a scam, such as prices that seem too low for the market, high upfront fees without proper documentation, or pressure to act quickly without seeing the property.

- Suspiciously Low Monthly Payments: If the rent or rent to own payment is significantly lower than other local listings, it could be a scam trying to attract as many potential victims as possible.

- Lack of Proper Documentation: Be cautious if the person you’re dealing with cannot provide legitimate paperwork or avoids showing the official property documents.

- Upfront Fees Before Viewing: You should never be asked to pay application fees, security deposits, or other charges before you’ve even seen the property.

- Payment Methods: A major red flag is if the seller insists on payment through gift cards, money orders, or wire transfers that are difficult to trace and impossible to refund.

- Rushed Process: If there is pressure to sign agreements quickly without giving you time to read the fine print or seek advice, it’s likely a scam.

- No Credit or Background Checks: Legitimate rent to own sellers will be interested in your credit history and financial stability. A lack of interest in these areas is suspicious.

- Unverifiable Contact Information: If the seller’s contact information is limited to an email or a single phone number with no physical address or company backing, be wary.

- No In-Person Meetings or Showings: A legitimate landlord or seller will always be willing to meet in person and show you the property. If they make excuses or refuse, it’s not a good sign.

- High-Pressure Sales Tactics: Scammers often create a false sense of urgency by claiming there is a high demand for the property to hurry you into making payments.

- Inconsistent Details: If the listing details vary across different websites or the seller provides conflicting information, it could indicate a scam.

- Bad Reviews or Online Presence: A quick internet search can reveal if others have had bad experiences with the supposed seller or property.

- Requests for Personal Information: Be cautious if asked to provide sensitive personal information like social security numbers or bank details early in the process.

How to Protect Yourself

Arm yourself against potential rent to own scams by becoming savvy about the common tactics used by fraudsters, and always verify property details and ownership, never pay upfront fees without thorough vetting, and consult with a real estate professional before making any commitments.

- Verify Ownership: Research the property records to confirm the person you’re dealing with is the actual owner of the property.

- Inspect the Property: Always visit and inspect the property in person before agreeing to any terms or making payments.

- Seek Professional Help: Consult with a real estate attorney or a housing counselor before entering into a rent-to-own agreement.

- Understand the Agreement: Ensure that all terms, responsibilities, and expectations are clear and written in an official contract.

- Avoid Unusual Payment Methods: Never agree to pay with gift cards, wire transfers, or other untraceable methods.

- Don’t Rush: Take your time to read all documents thoroughly and don’t let anyone pressure you into signing quickly.

- Secure Personal Information: Be cautious about sharing personal and financial information—legitimate landlords or sellers will not ask for sensitive details upfront.

- Check for Reviews: Look up the seller or the property online to see if there are any reviews or reports of scams.

- Trust Your Instincts: If something feels off, it probably is. Trust your gut feeling when it comes to assessing rent-to-own opportunities.

- Report Suspicious Activity: If you encounter a scam, report it to the authorities to help prevent others from falling victim.

It’s crucial to approach these rent to own opportunities with a healthy dose of skepticism. Remember, if a rental deal on social media seems too good to be true, especially if it’s for a quaint home at an unbelievably low price, it probably is. Scammers are counting on the excitement and hope these posts generate to lead you to their scammy links. Always do your research, ask for direct contact with the owner, and never give out personal information or money until you’ve verified that the deal is legitimate.

What to Do if You Suspect a Scam

If you suspect that you’re dealing with a rent to own scam, taking swift and decisive action can help protect yourself and others from falling victim to similar frauds. Here’s what you should do:

- Cease Communication: Immediately stop all communication with the individual or entity if you suspect fraudulent activity. Scammers may try to pressure or lure you back in, so it’s important to cut off contact.

- Document Everything: Keep records of all communications, including emails, texts, social media messages, and any phone call details. Save copies of the listing and any correspondence.

- Report to Authorities: File a report with your local police department, especially if you have lost money or given out personal information. This can help initiate an investigation and possibly prevent further scams.

- Notify Social Media Platforms: Report the suspicious listing to the platform where you found it. Platforms like Facebook have reporting features that allow you to flag potentially fraudulent activity.

- Contact Consumer Protection Agencies: Inform consumer protection agencies such as the Federal Trade Commission (FTC) or your state’s consumer protection office. These agencies can take broader actions against scammers.

- Alert Credit Bureaus: If you’ve provided any personal financial information, contact the three major credit bureaus (Equifax, Experian, and TransUnion) to place a fraud alert on your credit report.

- Inform Community: Consider sharing your experience in a measured way within your community or social circles to raise awareness and prevent others from being scammed under similar circumstances.

Remember, acting quickly can be crucial in limiting the damage and bringing scammers to justice. Your actions can also serve as a warning to help others avoid the same pitfalls.

Relief Recap

While rent to own opportunities can be a stepping stone to homeownership for many, the journey is fraught with potential pitfalls in the form of rent to own scams. By staying vigilant and recognizing the red flags outlined in this article, you can safeguard yourself against fraudulent schemes that prey on the hopeful and unsuspecting. Remember, legitimate deals will withstand scrutiny—so do your due diligence, consult with professionals, and trust your instincts. If an offer seems too good to be true, it probably is.