According to the US Bureau of Labor Statistics, May 2022 ended with a shocking inflation rate of 8.6 percent. This is the highest 12 month increase since over 40 years ago during December 1981 – the year of the Iran Hostage Crisis. Many Americans may be wondering what this means for their financial futures. As a result, Low Income Relief has gathered the statistics for you, so you can have a better understanding on the nation’s current economic state.

What Exactly is Inflation?

Inflation measures how quickly the prices of goods and services are rising in a particular economy.

Typically, it occurs due to various factors:

- increases in production costs, due to increased prices for wages or raw materials

- an upward surge in demand, either for products or services, that consumers are still willing to pay more for

- a decrease in supply or the general workforce

Currently, economists explain that the rate is presently high due to the uptick in consumption following the lockdown portion of the COVID-19 Pandemic, coupled with the recent Russian invasion of Ukraine.

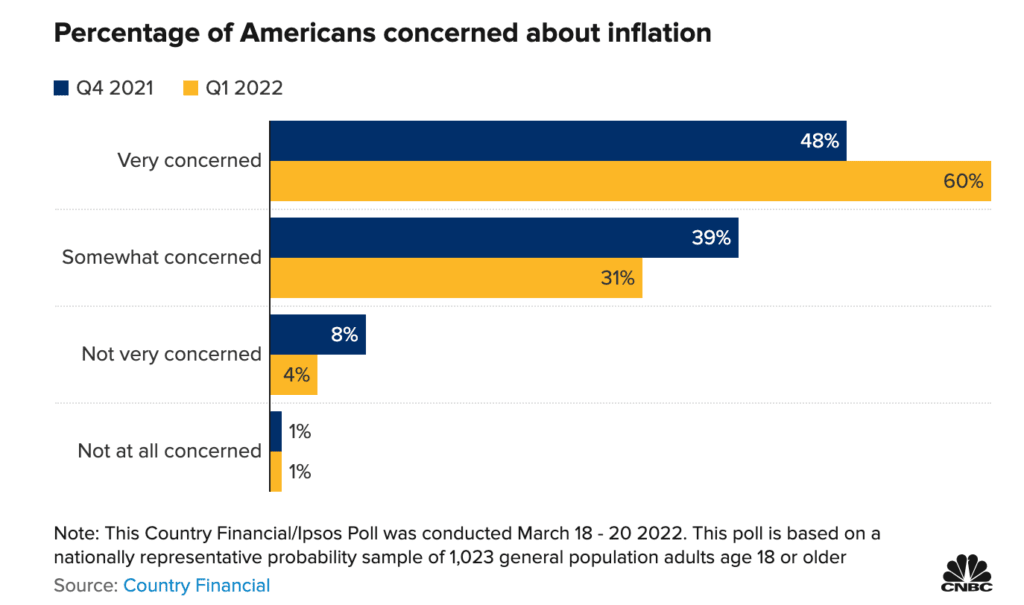

60% of Americans are “very concerned” about the current inflation rate

According to a survey conducted by Country Financial Security Index, about 90% of Americans are either “somewhat concerned” or “very concerned” about inflation. This survey was based on a nationally representative survey sample and conducted in early March 2022, before inflation even reached 8.6%.

Since the end of 2021, inflation has become a growing concern for Americans, evidenced in the graph below.

70% of Americans consider inflation to be the country’s largest problem

According to the Pew Research Center, inflation was the number one issue that Americans ranked as the “top problem” facing the United States today. Inflation topped other major issues, including the affordability of health care, violent crime, and gun violence. While 70 percent of respondents ranked inflation as a “very big issue,” only 55 percent of respondents ranked second place, health care, as a “very big issue.” This demonstrates just how seriously Americans are taking our nation’s current economic state.

How has this rate changed from last year?

At this time last year, the inflation rate was only 7.0 percent. While this is still high, this was a 12 month calculation. On average, the rate was only 4.7 percent throughout the year.

Here are the average rates from other recent years:

- 2021: average rate of 4.7

- 2020: average rate of 1.2

- 2019: average rate of 1.8

- 2018: average rate of 2.4

- 2017: average rate of 2.1

- 2016: average rate of 1.3

- 2015: average rate of 0.1

- 2014: average rate of 1.6

- 2013: average rate of 1.5

- 2012: average rate of 2.1

Food currently has an inflation rate of 10.1 percent

According to the Consumer Price Index, food at home has a rate of 11.9 percent, compared to food away from home which only has a rate of 7.4. This means that consumers actually have a higher buying power when dining out, versus preparing food at home. However, this is also bad news for the restaurant industry, since restaurants are unable to raise their prices to match those of their rising costs.

This is also bad news for the average American who prefers to prepare their own meals at home, particularly for meat eaters. According to CBS News, food prices are at the highest they have been in 40 years, with meat products bearing the greatest price increases. More specifically, since last year, pork has increased by 14% and beef has increased by 20%.

Here are the inflation rates for other common household foods:

- Dairy products: 11.8 percent

- Fruits and vegetables: 8.5 percent

- Nonalcoholic beverages: 13.6 percent

- Coffee: 15.4 percent

- Peanut Butter: 13.8 percent

- Margarine: 25.4 percent

- Other food at home (eg sweets): 13.0 percent

Please note that the above rates are based on unadjusted changes from the 12 month period of May 2021- May 2022.

Energy currently has an inflation rate of 34.6 percent

While the average rate of energy costs already has a high inflation rate, the rate specifically for fuel oil is at a staggering 106.7 percent. According to Politico, the national average for a tank of gas in the United States is at about $5 per gallon, as of June 10, 2022.

While many Americans have anecdotally reported filling up their gas tank less frequently, Politico reports that Americans are actually getting gas at the highest rate in three years. While this may be due to the COVID-19 Pandemic, where many Americans were opting to not travel either due to preference or travel restrictions, this rate is still shocking.

During the week of May 30 to June 3, Americans pumped about 9.2 million barrels of gasoline per day, the highest rate this year and since the summer of 2019.

Other essentials are also increasing in price

Food and fuel are not the only commodities impacted by inflation. From May 2021 to May 2022, rent also saw a 5.2 percent increase in its inflation rate.

According to NPR, the national average for rent prices increased a whopping 15 percent since last year. As a result, the median listed rent price shot above $2,000 per month. NPR reports that this is the first time the median rent has been this high. Without affordable housing, low income Americans may start to cut back on other goods to afford rent, such as food, gas, medicine, and other essentials.

Counties with the highest rates for increasing rent during the COVID-19 Pandemic, according to the Washington Post:

- Chambers County, Alabama: 44%

- Rockdale County, Georgia: 40%

- Collier County, Florida: 39%

- Limestone County, Alabama: 37%

- Lewis and Clark County, Montana: 37%

- Manataee County, Florida: 35%

- Coweta County, Georgia: 34%

- Sarasota County, Florida: 34%

- Otsego County, Michigan: 33%

- Walton County, Florida: 33%

Which Americans are hurt most by rising inflation?

As expected, low income Americans are hit the hardest by these shockingly high inflation rates. According to CBS News, this is because low income Americans spend a larger portion of their income on daily necessities, such as food, rent, and fuel, which are all at a historic high.

If you’re struggling due to the rising costs of inflation, Low Income Relief is here to help connect you to valuable resources. Check out some of our other recent articles, such as one highlighting which dollar stores take EBT cards, to help you make more financially savvy choices.